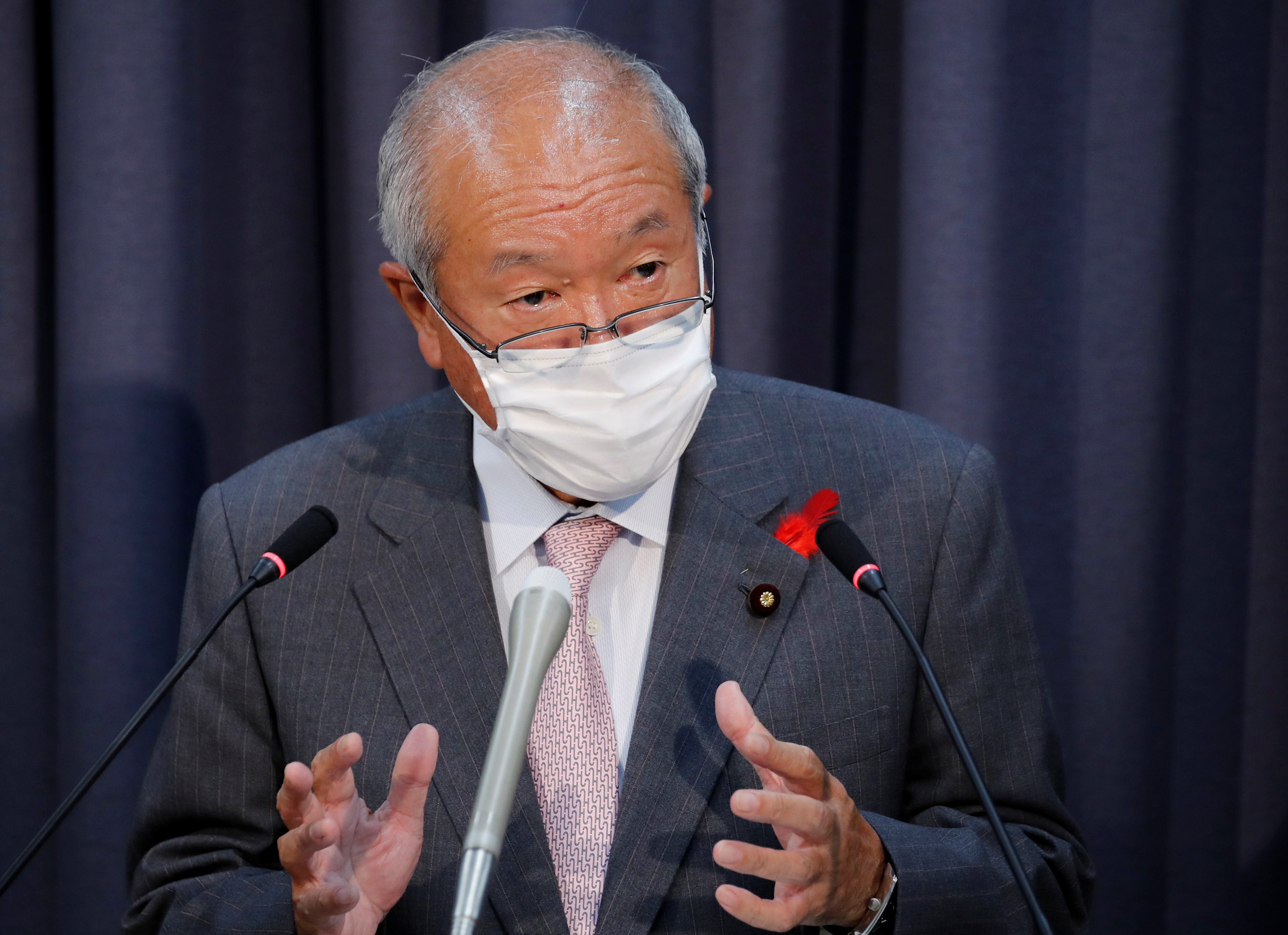

Image: Reuters Berita 24 English - Friday, Japanese Finance Minister Shunichi Suzuki didn't say anything about the possibility of the go...

|

| Image: Reuters |

Berita 24 English - Friday, Japanese Finance Minister Shunichi Suzuki didn't say anything about the possibility of the government getting involved in the foreign exchange market to stop the weak yen. He also didn't change his warning about sudden changes.

The latest jaw-boning happened a day after the yen hit a new 20-year low against the dollar and a seven-year low against the euro on expectations that the Bank of Japan (BOJ) will continue to lag behind other major central banks in ending their stimulus policies.

Senior officials from the Ministry of Finance, the Bank of Japan, and the Financial Services Agency will get together on Friday at 4 p.m. (0700GMT) to talk about what's going on in the global market.

The trend of a weak yen has caused the prices of imported goods to go up and the cost of living in Japan to go up.

When reporters asked Suzuki about the possibility of intervention, he said, "I won't say anything about currency levels or the question of intervention because I don't want a casual remark to make a difference."

"The most important thing is to have a stable currency, as quick changes are not good," Suzuki said at a news conference, repeating the official line.

"We will continue to keep a close eye on the changes in the currency market and how they affect Japan's economy."

Thursday, the value of the yen fell to 134.56 yen per dollar, which is a new 20-year low.

Daisaku Ueno, chief forex strategist at Mitsubishi UFJ Morgan Stanley Securities, said that the fall of the yen put the Japanese government in a tough spot.

Ueno said, "Verbal intervention isn't working, and it hasn't reached a dangerous level around 145 yen that I think calls for action."

So far this year, the yen has lost about 14% of its value against the dollar. Last time I checked, it was worth about 133.88 yen per dollar.

Ueno said that, in theory, Japan could act on its own and step in, as long as it told U.S. authorities ahead of time.

"But that would upset (U.S. Treasury Secretary Janet) Yellen, who is a firm believer in letting the market decide exchange rates, especially now when the U.S. is fighting rising inflation," he said.

Even though Japanese officials have repeatedly warned about the recent weakening of the yen, they have no plans to intervene in the exchange market. This is partly because a strong U.S. dollar suggests that the currency's drop is due to fundamental reasons.

A government source who knew about the situation told Reuters on the condition of anonymity that the speed with which the yen moved would be more important than any specific levels in deciding whether or not to step in.

Suzuki said on Friday that the Japanese government would act in a way that was in line with the Group of Seven's agreement on foreign exchange.

Analysts can't agree on when the government should step in and change the currency.

Some investors used to think that when the yen reached 125 yen to the dollar, it would be time to act on the foreign exchange market. This level was called the "Kuroda line" because BOJ Governor Haruhiko Kuroda warned of danger when the yen reached that level in 2015.