Berita 24 English - Global equity markets advanced on Monday. At the same time, the dollar fell to near four-month lows against a basket of...

Berita 24 English - Global equity markets advanced on Monday. At the same time, the dollar fell to near four-month lows against a basket of major currencies, as investors awaited the release of upcoming US inflation data for guidance on monetary policy.

Market participants were bracing for Thursday's release of personal consumption data in the United States – the Federal Reserve's preferred inflation indicator – and the possibility of a tapering of asset purchases in the face of strong economic data.

The benchmark 10-year US Treasury note yield fell to one-week lows, while safe-haven gold edged higher.

"The market is taking a deep breath and adjusting to inflation," said Thomas Hayes, managing member at New York-based Great Hill Capital.

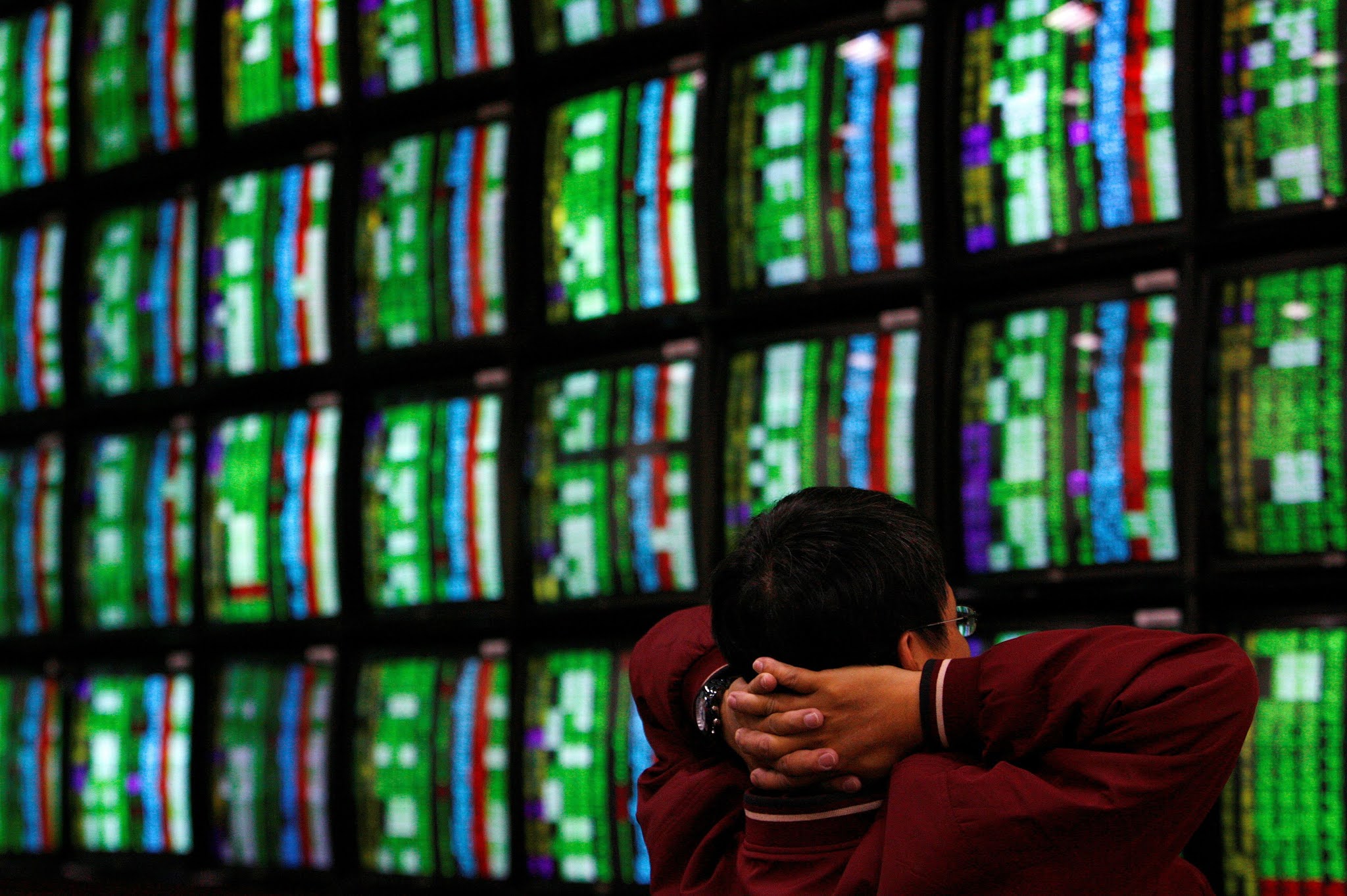

MSCI's world equity index increased 0.66 per cent to 706.20 points. Europe's broad FTSEurofirst 300 index gained 0.10 per cent to close at 1,715.51, aided by technology stocks.

The Dow Jones Industrial Average increased 0.54 per cent to 34,393.98, the S&P 500 increased 0.99 per cent to 4,197.05, and the Nasdaq Composite increased 1.41 per cent to 13,661.17.

MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.1 per cent overnight in slow trade in Asia. The Nikkei 225 index in Japan gained 0.2 per cent, while Chinese blue chips gained 0.4 per cent.

Emerging market stocks fell 0.16 per cent on Monday following Belarusian authorities' forced landing of an airliner and arresting an opposition-minded journalist on board, drawing condemnation from Europe and the United States.

Following Friday's surveys of global services sectors, all eyes will be on personal consumption and inflation figures in the United States this week.

A high core inflation reading would raise alarm bells and could rekindle talk of the Federal Reserve beginning its tapering sooner than expected.

"The market was concerned that the Fed would fall behind the curve with tapering, but that does not appear to be the case, as commodity prices have stabilized," Hayes said.

In afternoon trading in New York, the dollar index hovered near the 90 levels, down 0.2 per cent on the day but slightly above a four-month low of 89.646 set on Friday.

The yield on the US 10-year Treasury note decreased to 1.6046 per cent from 1.632 per cent late Friday.

Oil prices increased more than 3% on Monday as traders gained confidence that the market can absorb any Iranian oil that comes onto the market due to Western talks with Tehran that result in the lifting of sanctions.

Brent crude oil futures settled up $2.02, or 3%, at $68.46 a barrel, while July West Texas Intermediate crude oil futures ended up $2.47, or 3.9 per cent, at $66.05 a barrel.

At 4:35 p.m. ET, spot gold was up 0.11 per cent to $1,882.3100 per ounce.

On Monday, digital currencies recovered some of the ground lost during a weekend sell-off sparked by renewed signs of a Chinese crackdown on the emerging market.

Bitcoin, the world's largest cryptocurrency, was last up 13% to around $39,400, erasing a day's loss of 7.5 per cent. Ether, the second-largest cryptocurrency, increased nearly 19 per cent to $2,491 following a more than 8% decline on Sunday to a near two-month low.